Business Beyond Boundaries.

Macanne® is The Only Multi-Platform Agency. Trusted by many since 2012.

Experienced teams and an agile framework, combined with an ever growing passion for creativity we take our clients to futureproof their ventures and deliver the highest business value.

We provide clients

with award-winning services

Our best projects from our caliber team.

Some Industries we’ve excelled in

Digital Marketing

Reach the right customers and get outstanding engagements like no other. Be know, and Be in the know, beyond boundaries

Web Hosting and Development

Maximize your digital presence by entrusting us to host and develop your next website within Macanne’s exclusive ecosystem. No third parties, No Fuss.

Fintech

Fintech projects are strict.

We bring our innovative approach to it.

Organizations recognized our work

Council 2022

Agency

in Ireland 2023

Macanne has been recognized as one of the top agencies in Dublin (2023)

We use latest technologies to run your project smoothly

Get what you need. Pay only for what you use.

Collective Experience

All-time

helped

Globally

Meet Our Team

Macky Daus

Co-Founder and Chief Innovations Officer

Darren Dario

Co Founder and Cloud Director

Mich De Joya

Managing Director and Business Operations

Antonette Aquino

Co-Founder and Chief Digital Correspondent

Lauren Connolly

EU Operations Head

Latest Insight

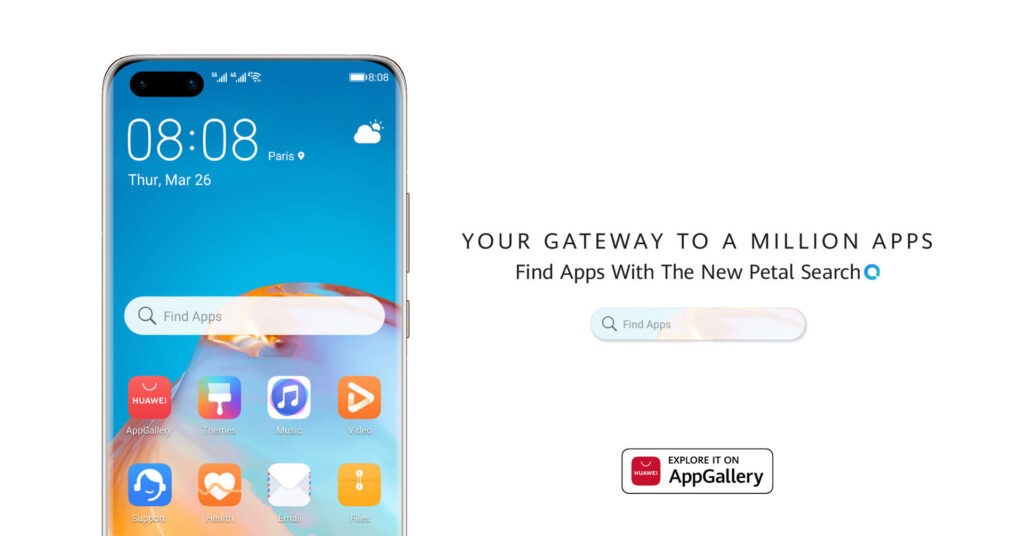

Huawei PetalSearch

Petal Search is one of the key applications in Huawei’s ecosystem. It’s essentially a search engine app developed by Huawei that aims to provide users with comprehensive search results and access to various types of content. Petal Search is designed to help users find information, apps, news, images, videos, and more, directly from their Huawei devices.

✔︎ Digital transformation

✔︎ Consulting services